Ci-dessous une contribution en anglais de Simon Jacques, Commodity Merchant Trading and Shipping Advisory (Canada, 1 226 348 5610) concernant une étude de cas intéressante sur une L.O.I. Ce document basé sur des faits réels vous permettra ausssi de vous familiariser sur le (bon) déroulement (ou pas) d'un crédit documentaire. Bonne lecture !

The most elementary role of a banker/lender specialized in TCF (Trade and Commodity Finance) is to support the activity of a client operating in a trade, mainly covering the payment risk for the time encompassing the loading, transportation and delivery of the commodity while mitigating the associated risks throughout the life of the transaction.

The basic premise is that the repayment will follow the liquidation of a sale/export contract, so the aim is stay as close as possible to the collateral in whatever form it is available which will lead to the fulfilment of that export contract.

The bankers/lenders establish the nature of the trade flow.

Who is buying what from whom? Where do commodities originate? Where do they stop during the process? Where do they go prior to shipment, where do they end up after the cargo shipment and how is all this evidenced?

They determine the buyer/offtaker payment risk acceptability. Will the offtaker have the capacity and willingness to pay ? To put their institutions off the hook, lenders/specialists must master their collateral. Where security may be taken, from whom and how it should be pledged in the documentation?

Seeking to disentangle the aspects of sale contract between the seller, the buyer and their various linkages to the terms and conditions of the document credit agreement, the specialist will create an outline of the transactional flows.

1. Nature of the Trade Flow

Trafigura Beheer B.V (Trafigura) had purchased the decant oil from Pertamina PT, the Indonesian oil major.

Decant

oil is a high-boiling cat cracked aromatic process, used in the

manufacture of carbon black, burning fuel or in the blending of heavy

fuel oils (bunker fuel oil).

The

buyer was Huron Co and the seller of the cargo was Trafigura. In order to

fulfill the sale contract, Trafigura had concluded a tanker

charterparty (c/p) and arranged the transportation from Indonesia to

Korea. The duration of the voyage was 11 sea days.

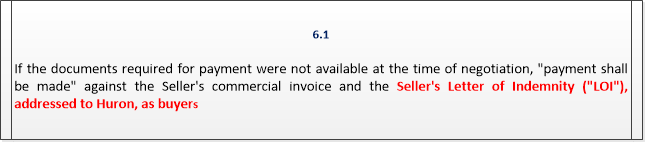

Clause 8 of the Sale contract provided that if any of the documents were not available at the payment due date, then the Seller should present the commercial invoice plus a Seller’s LOI to be issued or to indorsed to order of buyer.

➤ Bills of ladings (B/Ls) are a critical document acting as an evidence of the contract of carriage between the shipper and the carrier (a proof for the banker/lender that the financed commodity has actually been shipped). B/Ls also act as a document title: the possession of the goods can be passed by endorsement and delivery of the B/L from one party to another. (Collateral)

2. The L/C issued by Kookmin.

➤ Bills of ladings (B/Ls) are a critical document acting as an evidence of the contract of carriage between the shipper and the carrier (a proof for the banker/lender that the financed commodity has actually been shipped). B/Ls also act as a document title: the possession of the goods can be passed by endorsement and delivery of the B/L from one party to another. (Collateral)

In

the waterborne cargo trade, B/Ls have to be physically checked and

endorsed following each transfer of title along a chain of buyers and

banks. However this doesn’t take into consideration that the cargo may

arrive before the documents. Without the original B/Ls, a commodity trader (beneficiary) cannot

obtain payment from the buyer under the L/C.

Sophisticated commodity traders facing this intermediary situation at the discharge port have relied on LOIs. LOIs are commonly used to change a destination or enable a cargo to be discharged without the original B/Ls to obtaining the payment under the L/C and to avoid demurrage in the physical commodity trade.

➤ Letter of Indemnities (LOIs) present a unconditional acceptance

of the documents under documentary credit as it indemnifies the receiver

of the indemnity against any cost or consequence of failure to provide

the original shipping documents or breach of the above terms under

documentary credit including quality/quantity.

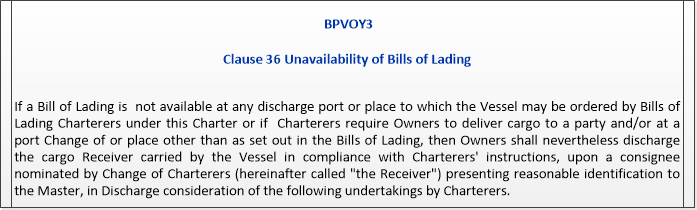

➤ Clause 36 of the BPVoy3 contract concluded by Trafigura with the Ship owner provided that the charterers to give the ship owners orders to discharge the cargo without production of bills of lading if one was not available at the discharge port.

To discharge of cargo without the presentation of an original B/L, Trafigura had issued a LOI in favor of carrier.

➤ Clause 36 of the BPVoy3 contract concluded by Trafigura with the Ship owner provided that the charterers to give the ship owners orders to discharge the cargo without production of bills of lading if one was not available at the discharge port.

To discharge of cargo without the presentation of an original B/L, Trafigura had issued a LOI in favor of carrier.

2. The L/C issued by Kookmin.

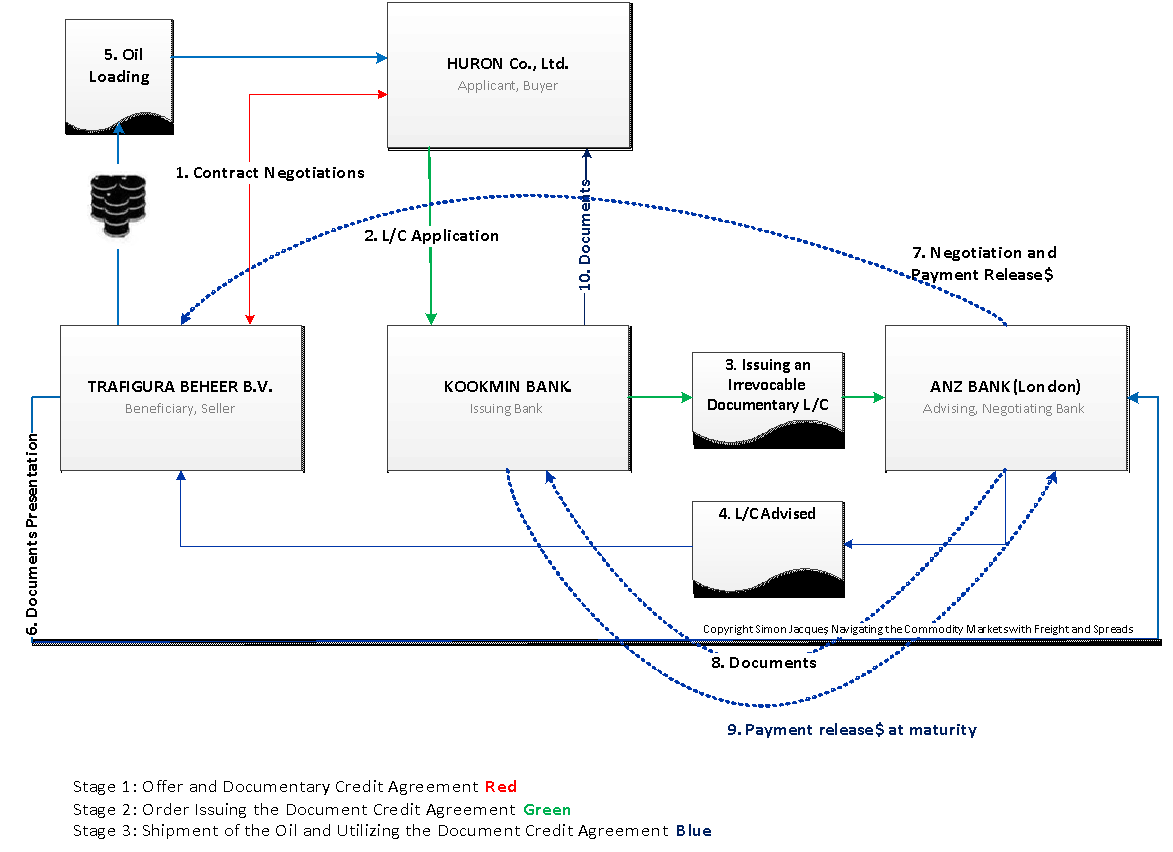

Huron applied to Kookmin Bank, for a Letter of Credit (L/C) in order that Huron could comply with the payment terms of the sale contract with Trafigura, the beneficiary, in the sum of US $5,920,000.

Figure 1. Outline of the documentary credit transaction from the perspective of the TCF bank.

Figure 1. Outline of the documentary credit transaction from the perspective of the TCF bank.

Negotiation

Field 41D provided that the L/C is made available by negotiation.

Trafigura, the beneficiary, is one of the world’s leading international commodity traders realizing more than 2350 chartering fixtures per year 1. There is a substantial refinance market for their performance-risk*.

The “negotiation” is effectively the purchase of documents at a discount by the negotiating bank, ANZ bank London-branch, for a fee on the account of the beneficiary.

Once ANZ Bank had received the documents presented by Trafigura and determined that they were compliant, cash would become available. The Issuing bank would pay the negotiating bank at maturity, upon the compliance of documents received.

Presentation of the documents

Field 46A of the L/C set out what documents had to be presented for payment under the L/C.

As a rule, a B/L is issued in several signed originals (plus copies). All the originals together are referred to as a “full set” and as soon as one of the B/Ls has been presented for the purpose of obtaining the release of the goods, the others become invalid.

The bank will therefore insist that the beneficiary will present the full set, unless the credit contains a provision to the contrary.

Field 46A of the L/C provided that the B/L be "issued to or endorsed to the Order of Kookmin Bank Seoul, Korea" but Field 47A of the L/C set out additional conditions :

As in the Sale Contract, (to discharge the cargo without production of bills of lading if one was not available at the discharge port) the LOI was to be addressed to Huron, as buyers, not to Kookmin bank.

The tanker voyage charterparty provided another relevant piece of information.

3. Trafigura Beheer BV v Kookmin Bank Co - What went wrong

Figure 2: Physical trading timeline

15 November 2003: Cargo loading started in Balongan, Indonesia

18 November 2003: loading is completed

24 November 2003: Trafigura sent a fax message to the ship-owners. This stated:

18 November 2003: loading is completed

24 November 2003: Trafigura sent a fax message to the ship-owners. This stated:

"We hereby invoke the LOI as per clause 36 in the charterparty.

We hereby request you to discharge all cargo onboard to receiver Huron Co Ltd at discharge port Pyongtaek, Korea without production of original bills of lading.

Please kindly confirm LOI is in order for discharge".

November 29 2003: The vessel arrives at the discharge port, Pyontaek, Korea

November 30 2003: Discharge starts.

December 2 2003: Discharge is completed.

November 30 2003: Discharge starts.

December 2 2003: Discharge is completed.

Figure 3: Transactional Flows

December 4 2003: Trafigura noted several oddities in the B/L.

- References to the shipper, ports and freight notations are wrong, not in the format of the L/C.

- The B/Ls were made out to order of the ANZ Bank, the negotiating bank instead of the issuing bank.

Trafigura decided to deal posed by these discrepancies by following the alternative course for which the L/C provided, namely, to supply its commercial invoice and the LOI, in the prescribed format, to ANZ Bank in London (was to be addressed to Huron, as buyers).

December 11 2003: Trafigura presented the documents for payment under the L/C to the ANZ Bank in London, the advising bank.

December 15 2003: ANZ bank wrote to Kookmin, claiming reimbursement under the terms of the L/C. With this letter it enclosed documents, which consisted of a draft and invoices. The letter states "we certify all terms and conditions are complied with".

December 13 2003: ANZ bank had paid Trafigura the price of the cargo.

December 15 2003: ANZ bank wrote to Kookmin, claiming reimbursement under the terms of the L/C. With this letter it enclosed documents, which consisted of a draft and invoices. The letter states "we certify all terms and conditions are complied with".

December 31 2003: The cargo is released to Huron.

January 2004: Huron went into liquidation. Kookmin has not been reimbursed by Huron for the payment made to Trafigura under the L/C.

January 12 2004: Kookmin sent a message to ANZ requiring the full set 3/3 B/Ls. The request was passed to Trafigura's Trade Finance Department.

January 14 2014: Trafigura took the three B/Ls to the office of Tanker Pacific Management, the managers of the vessel, intended to exchange the three original bills of lading were discrepant for the purposes of the L/C for new "original" bills of lading which he intended would conform to the L/C terms. Tanker Pacific Management (TPM) was prepared to make this exchange, upon the condition that the new bills were "marked voyage accomplished null and void" on the back of each of the three new bills of lading, in order to indicate that the voyage had been completed. Trafigura countersigned that endorsement.

TPM retained one of the set of the three new bills, saying that they were doing so on behalf of the Master.

Janurary 20 2004: the two B/Ls are submitted up the banking chain to Kookmin.

February 4 2004: Kookmin sent a message to ANZ Bank, London requiring the missing 1/3 set of B/L retained by the vessel's managers on behalf of the master.

February 5 2004: ANZ Bank in London responded to Kookmin and said that it had only received two of the three original B/L.

November 2004: Kookmin issued proceedings in the Seoul Central District Court against the owners of Shanghai (Marelia Overseas Inc), the managers of the vessel, Tanker Pacific Management, the shippers, Pertamina, and Trafigura. The Claim Form sought judgment against each of those defendants for US$ 5,826,032.71 plus interest.

Conclusions

What has transpired with Kookmin Bank is that the lender had simply not perfected title to their collateral.

The documentation was in favour of the applicant, not the institution financing the oil trade. Kookmin was holding Huron’s company risk.

Trafigura got paid for the cargo under the L/C.

- The L/C issued by Kookmin required that "Bills of Lading be issued to or endorsed to the order of Kookmin Bank, Seoul, Korea (issuing bank)" but field 47A also stipulated that in the absence of Bills of Lading the payment was to be effected against the Commercial Invoice and Letter of Indemnity issued by Trafigura in favor of Huron.

- To comply with the documentary credit, Trafigura opted for the alternative course provided by 47A in the L/C.

The carrier got his freight paid.

- By complying with Trafigura’s voyage instructions and completing the voyage, abiding to clauses in the charter-party.

- The carrier would also discharge the cargo to Huron at the destination port without the production of the B/L against an LOI tendered in the favor by Trafigura.

Huron got the oil.

- By presenting the commercial invoice and Trafigura’s LOI issued to order of Huron specified by Clause 8 of the Sale contract to the carrier.

However Kookmin has not been reimbursed by Huron, completely failing towards a satisfactory resolution of the transaction.

Not requiring the LOI issued in favor of the Issuing Bank was a due diligence red card for Kookmin. This has prevented the bank to take the necessary to ‘step into the shoes’ of its applicant.

What has also emerged in the Kookmin structure is that the bank had no multiple layers of risk mitigations in place.

For instance, the issuance of the documentary credit had not been matched by higher over-collateralization; Huron had no skin in the game.

What kind of banking relationship Kookmin had with Huron to open them a $5.9M L/C ? Kookmin as a financial institution must had had a credit risk assessment of their counterparty. Did Huron bank in the past with Kookmin? Was Huron over geared ?

By failing to prioritize the minimum requirements to secure their position prior the issue of the documentary credit well before the money was away from home, Kookmin was not banking, but trading “open terms”.

Thank you for reading.

References

- Trafigura Beheer B.V, Partnership in Ocean Freight, 2015

- Jacques. S. Crude Oil Trade: Oil and Freight Hedging Process Flows, Swiss Derivatives Review 60, 2015

- Based on Trafigura Beheer BV v Kookmin Bank Co [2006] EWHC 1450 (Comm) (16 June 2006) http://www.bailii.org/ew/cases/EWHC/Comm/2006/1450.html

Simon Jacques

Aucun commentaire:

Enregistrer un commentaire